GAARMAGEDDON.COM

Cases Decided

On GAAR

(D.O.G.) D.O.G.

Post

Trustco

|

All GAAR Cases |

Decided On GAAR (D.O.G.) |

D.O.G. Post Trustco |

||||

| C | T | C | T | C | T | |

| SCC | ||||||

| FCA | ||||||

| TCC | ||||||

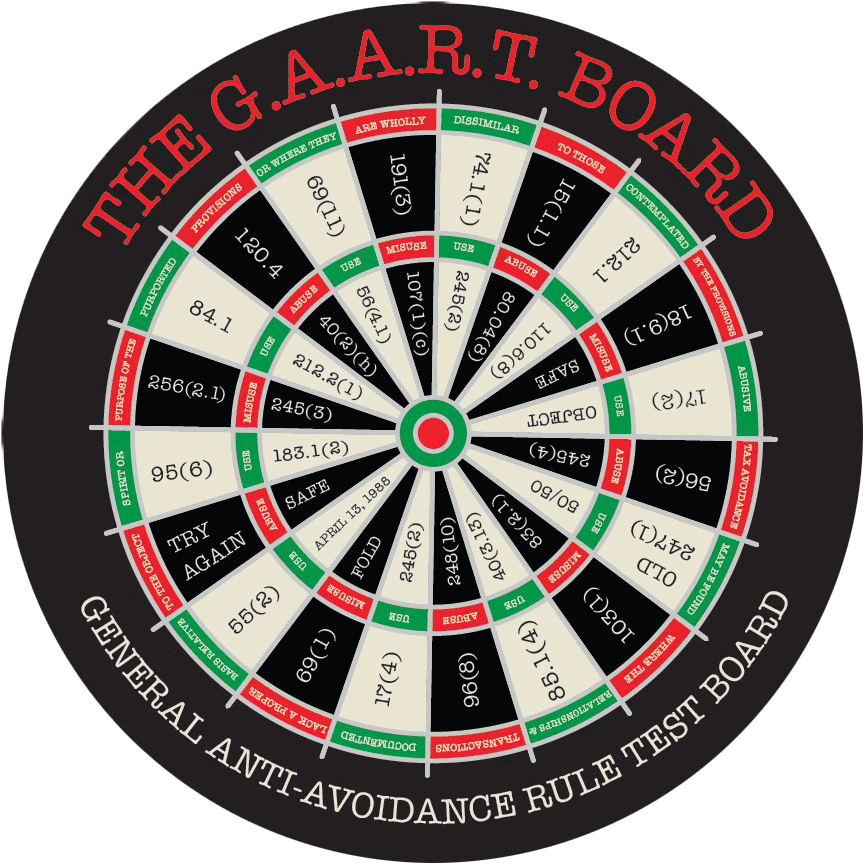

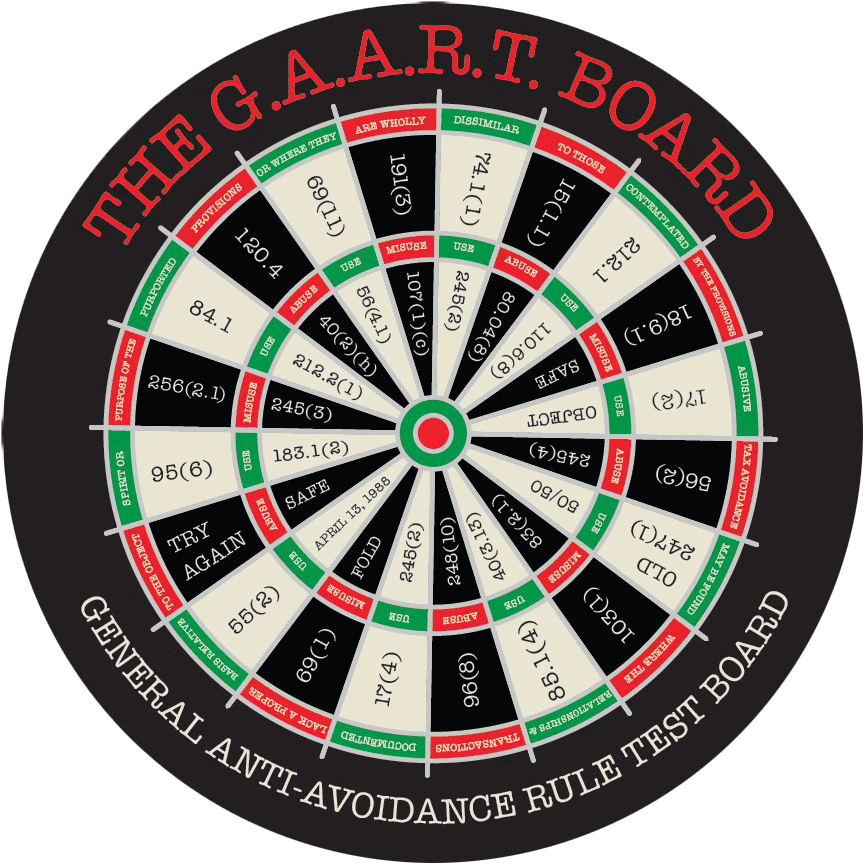

| FC | ||||||

The table below represents an inventory of GAAR cases in Canada analysed for primary and secondary bases of assessment together with outcomes at that level. Finally there will be a running tally maintained, adjusted for outcomes of respective upward appeals. Based on a methodology where I eliminate procedural cases or cases that have been appealed and decided by a higher court or not ultimately decided on the GAAR. Resulting in the score as reflected in the scoreboard above. A case like Golini is interesting in that the deciding Judge ruled in the Crown’s favour on the primary basis of assessment (shareholder benefit), and would have applied the GAAR (secondary basis of assessment), however, while it was not decided on the GAAR, I have scored it as “Decided on GAAR” (DOG) since the Judge did say it would have applied in the alternative, accordingly scored as a GAAR victory for the Crown. Based on the stats added to the table for the relevant taxation year and when notice of appeals are filed, it appears it is taking around 11.5 years from the transaction year and about 5 years from the date of filing the initial notice of appeal to get a decision on GAAR (mostly since, and including Canada Trustco), although Gladwin took less than three years. This is up from previously quoted duration statistics, which may be attributable to the Covid-19 Pandemic and certain model improvements. I am building out these stats in hopes that one day AI software will emerge that easily helps daily users predict the future of GAAR outcomes. Because “Knowing the Future, is the Future”©. NOTE THAT THERE ARE CHANGES IN THE NUMBER OF CASES, AS WE ARE TRYING TO DETERMINE THE STATUS OF CASES IN THE PIPELINE THAT HAVE BEEN SETTLED, AND SO CASES ARE SORTED BASED ON THE DATE OF THE INITIAL DECISION AT THE TAX COURT OR IF WITHDRAWN OR OTHERWISE SETTLED, BASED ON THE DATE OF WITHDRAWAL IF THAT CAN BE ASCERTAINED BASED ON THE DOCKETS.

The case table, is provided E&OE, this is not intended to to be legal advice and readers are cautioned to validate the data on their own before reaching conclusions. I am not responsible for abuse, misuse or misinterpretation of the information presented.

| Ref | Date of Decision | Initial Appellant Name | Court | Appeal # (linked) | Link to Appeal Docket | Firm(s) | Classification (Work in Progress) | Nature | Status | Case Name | Hearing Date | Date of Initial Notice of Appeal | Date File Closed or Latest Action | Citation | Disposition | Synopsis | Primary Issue | Secondary Issue | Outcome on Primary | Outcome on Secondary | Crown Score 48 (Post-Trustco 40) | Taxpayer Score 43 (Post-Trustco 28) | Decision on GAAR? Yes/No | Deciding Judge(s) | Dissenting Judge(s) | Crown Counsel | Taxpayer Counsel | Crown DoG Score 37 (Post-Trustco 29) | Taxpayer DoG Score 40 (Post-Trustco 26) | Link to Decision | Earliest Taxation Year | Number of Years Since End of Transaction Year to Resolution - 11.59 | Number of Years from Notice of Appeal to Most Recent Decision - 5.07 | Notes |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1126 | 2024-05-09 00:00:00 | DAC Investment Holdings Inc. | TCC | 2021-1079(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=195045 | Thorsteinssons LLP | General Anti Avoidance Rule - GAAR | Heard | DAC Investment Holdings Inc. v. His Majesty The King | 2023-05-23 00:00:00 | 2021-05-05 00:00:00 | 2024-05-09 00:00:00 | 2024 TCC 63 | Allowed | Continuance out of Canada of CCPC. | GAAR | Allowed | 0 | 1 | Yes | The Honourable Justice Steven K. D’Arcy | Arnold H. Bornstein Christopher M. Bartlett | Matthew G. Williams Florence SauveBrittany D. Rossler | 0 | 1 | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/521265/index.do | 2015 | 8.36 | 3.01 | |||||

| 1126 | 2024-05-06 00:00:00 | Investissements Hexagone Inc. | TCC | 2021-3205(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=197408 | De Grandpré Chait S.E.N.C.R.L./LLP | Income tax avoidance, Allowable Business Investment Loss (ABIL) | Withdrawn | 1970-01-01 00:00:00 | 2021-12-23 00:00:00 | 2024-05-06 00:00:00 | Withdrawal accepted prior to hearing | ||||||||||||||||||||||

| 1112 | 2024-04-05 00:00:00 | 1192896 Alberta Ltd. | N/A | 2017-940(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=175594 | Thorsteinssons LLP | Transfer of property s. 160(1), General Anti Avoidance Rule - GAAR | Settled | 1970-01-01 00:00:00 | 2017-03-01 00:00:00 | 2024-04-05 00:00:00 | N/A | Adj. prior to hearing - Sine die | N/A | First docket I have seen in a GAAR case labelled, "Settled" | |||||||||||||||||||

| 1111 | 2024-03-11 00:00:00 | DEML Investments Limited | TCC | 2017-922(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=175593 | McCarthy Tétrault LLP | General Anti Avoidance Rule - GAAR, Capital loss | Appealed to Higher Court | DEML INVESTMENTS LIMITED AND HIS MAJESTY THE KING | 2022-05-02 00:00:00 | 2017-02-28 00:00:00 | 2024-03-11 00:00:00 | 2023 TCC 27 | Dismissed | This is a general anti-avoidance rule (GAAR) matter, involving Canadian resource property (CRP) as defined in the federal Income Tax Act (Act). | GAAR | Dismissed | 1 | 0 | Yes | The Honourable Justice Bruce Russell | Grant Nash Carla Lamash | Anu Koshal Raj Koshal | 1 | 0 | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/521231/index.do?q=GAAR+or+%22General+anti-avoidance+rule%22 | 2007 | 16.21 | 7.04 | |||||

| 1119 | 2024-03-07 00:00:00 | 3295940 Canada Inc. v. The Queen | FCA | A-201-22 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | EY Cabinet d'avocats | General Anti Avoidance Rule - GAAR, Capital gain | Decision Received from Federal Court | 3295940 CANADA INC. AND HER MAJESTY THE QUEEN | 2023-11-15 00:00:00 | 2017-11-29 00:00:00 | 2024-03-07 00:00:00 | 2024 FCA 42 | Allowed | A “plain-vanilla tax‐planning opportunity” whereby Micsau used its high cost to be taxed on its true economic gain ended up being, for the Tax Court of Canada, an abusive avoidance transaction by 3295940. | GAAR | Allowed | 0 | 1 | Yes | GOYETTE J.A. DE MONTIGNY C.J. HECKMAN J.A. | Yanick Houle Sara Jahanbakhsh | Roger Taylor Daniel Sandler Alexandra Auger | 0 | 1 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/521355/index.do?q=GAAR+or+%22General+anti-avoidance+rule%22 | 2002 | 21.2 | 6.27 | Related Appeals: 2018-2246(IT)G Gestion Micsau Inc., |

||||

| 1128 | 2024-02-16 00:00:00 | Compass Group Canada Ltd. | TCC | 2022-1369(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=198970 | Osler, Hoskin & Harcourt LLP | General Anti Avoidance Rule - GAAR | Closed | 1970-01-01 00:00:00 | 2022-05-18 00:00:00 | 2024-02-16 00:00:00 | Consent Allowed Prior To Hearing | ||||||||||||||||||||||

| 1125 | 2024-02-15 00:00:00 | Onex Corporation | TCC | 2021-2885(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=197034 | Osler, Hoskin & Harcourt LLP | Withdrawal accepted prior to hearing | Closed | 1970-01-01 00:00:00 | 2021-11-18 00:00:00 | 2024-02-15 00:00:00 | Withdrawal accepted prior to hearing | ||||||||||||||||||||||

| 1098 | 2024-02-02 00:00:00 | Total Energy Services Inc. | TCC | 2016-367(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=168905 | Bennet Jones LLP | Scientific Research & Development Credit, General Anti Avoidance Rule - GAAR | Settled | Total Energy Services Inc. v. The King | 2022-06-20 00:00:00 | 2016-01-27 00:00:00 | 2024-02-02 00:00:00 | 2024 TCC 12 | Dismissed | This is another loss–trading case. | GAAR | Dismissed | 1 | 0 | Yes | The Honourable Justice F.J. Pizzitelli | Matthew Turnell Neva Beckie Alexander Wind Eric Brown | Jehad Haymour Wesley Novotny Sophie Virji Anna Lekash | 1 | 0 | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/521215/index.do?q=GAAR+or+%22General+anti-avoidance+rule%22 | 2010 | 13.1 | 8.02 | |||||

| 1092 | 2023-12-27 00:00:00 | Madison Pacific Properties | TCC | 2014-3959(IT)G | 2014-3959(IT)G | Thorsteinssons LLP | Capital loss, General Anti Avoidance Rule - GAAR | Appealed to Higher Court | MADISON PACIFIC PROPERTIES INC. v. HIS MAJESTY THE KING | 2020-11-10 00:00:00 | 2014-11-03 00:00:00 | 2023-12-27 00:00:00 | 2023 TCC 180 | Appealed to Higher Court | Loss-trading case. The appeal involves the application of the general anti-avoidance rule (the “GAAR”) to the Appellant’s deduction of net capital losses. | GAAR | Dismissed | 1 | 0 | Yes | The Honourable Justice David E. Graham | Perry Derksen Dominic Bédard-Lapointe (for all but November 17, 2023) Yanick Houle Eric Brown Erin Krawchuk (on November 17, 2023, only) | David R. Davies S. Natasha Kisilevsky Tyler Berg | 1 | 0 | 2023 TCC 180 | 2009 | 14 | 9.15 | Related Appeals: 2013-3888(IT)G 1073774 Properties Inc., 2018-540(IT)G Metro Vancouver Properties Corp., 2013-3885(IT)G MP Western Properties Inc., |

||||

| 1113 | 2023-12-13 00:00:00 | Husky Energy Inc. | TCC | 2017-1252(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=175937 | McCarthy Tétrault LLP | General Anti Avoidance Rule - GAAR | Appealed to Higher Court | HUSKY ENERGY INC. AND HIS MAJESTY THE KING HUTCHISON WHAMPOA LUXEMBOURG HOLDINGS S.À.R.L. AND HIS MAJESTY THE KING L.F. MANAGEMENT AND INVESTMENT S.A.R.L. AND HIS MAJESTY THE KING | 2023-01-09 00:00:00 | 2017-03-17 00:00:00 | 2023-12-13 00:00:00 | 2023 TCC 167 | Dismissed | Whether Part XIII of the Income Tax Act, R.S.C. 1985, c.1 (5th Supp.)(the “ITA”) was exigible on the Dividends at the rate of 15% or 5% under the Barbados Tax Treaty. | Rate of Part XIII Tax | GAAR | Allowed | Dismissed | 0 | 1 | Yes | The Honourable Justice John R. Owen | Pascal Tétrault Montano Cabezas David McLeod | Nicolas X. Cloutier Dominic Bédard-Lapointe Robert Celac Margaret Nixon Pierre‐Louis Le Saunier Zev Smith Louise R. Summerhill Josh Kumar Monica Carinci | 0 | 1 | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/521215/index.do?q=GAAR+or+%22General+anti-avoidance+rule%22 | 2003 | 19.96 | 6.75 | |||

| 1106 | 2023-11-30 00:00:00 | MMV Capital Partners Inc. | FCA | A-245-20 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Deloitte Tax Law LLP | General Anti Avoidance Rule - GAAR, Non capital losses | Allowed | HIS MAJESTY THE KING v. MMV CAPITAL PARTNERS INC. | 2023-10-31 00:00:00 | December 1, 2016 | 2023-11-30 00:00:00 | 2023 FCA 234 | Allowed | Whether a misuse of loss use restriction rules in section 111. | GAAR | Allowed | 1 | 0 | Yes | MONAGHAN J.A. WOODS J.A. LASKIN J.A. | Perry Derksen Matthew Turnell Eric Brown | Michael Collinge Kevin Chan | 1 | 0 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/521296/index.do?q=GAAR+or+%22General+anti-avoidance+rule%22 | 2011 | 11.92 | 7 | |||||

| 1120 | 2023-10-03 00:00:00 | Quebecor Inc. | TCC | 2018-979(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=181172 | Norton Rose Fulbright Canada | General Anti Avoidance Rule - GAAR | Appealed to Higher Court | QUEBECOR INC. AND HIS MAJESTY THE KING | 2021-06-29 00:00:00 | 2018-03-15 00:00:00 | 2023-10-03 00:00:00 | 2023 TCC 142 | Allowed | Series of related party transaction to move ACB to shelter gain on sale of shares. | GAAR | Allowed | 0 | 1 | Yes | The Honourable Justice Sylvain Ouimet | Natalie Goulard Marie-Aimée Cantin Sara Jahanbakhsh | Wilfrid Lefebvre Catherine Dubé | 0 | 1 | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/521165/index.do?q=GAAR+or+%22General+anti-avoidance+rule%22 | 2007 | 15.77 | 5.56 | |||||

| 1128 | 2023-09-27 00:00:00 | Canteen of Canada Limited | TCC | 2022-660(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=198099 | Osler, Hoskin & Harcourt LLP | General Anti Avoidance Rule - GAAR | Closed | 1970-01-01 00:00:00 | 2022-03-04 00:00:00 | 2023-09-27 00:00:00 | Consent Allowed Prior To Hearing | ||||||||||||||||||||||

| 1125 | 2023-07-28 00:00:00 | 3077603 Nova Scotia Limited | TCC | 2021-2883(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=197051 | Osler, Hoskin & Harcourt LLP | General Anti Avoidance Rule - GAAR | Closed | 1970-01-01 00:00:00 | 2021-11-18 00:00:00 | 2023-07-28 00:00:00 | Withdrawal accepted prior to hearing | ||||||||||||||||||||||

| 1105 | 2023-07-05 00:00:00 | Microbjo Properties Inc. | FCA | A-115-21 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Dentons Canada LLP | Transfer of property s. 160(1), General Anti Avoidance Rule - GAAR | Heard | Canada v. Microbjo Properties Inc. | 2020-09-21 00:00:00 | November 7, 2016 | 2023-07-05 00:00:00 | 2023 FCA 157 | Allowed | Consequences under section 160 of the ITA and under GAAR for transactions involving the sale of farmland in Brampton. | 160 Liability | GAAR | Allowed | Dismissed | 1 | 0 | Yes | NOËL C. BOIVIN J.A. GLEASON J.A. | Perry Derksen Laura Zumpano Eric Brown | Jacob Yau Yves St-Cyr Caroline Harrell | 0 | 1 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/521223/index.do?q=GAAR+or+%22General+anti-avoidance+rule%22 | 2006 | 16.52 | 6.66 | Crown won under section 160 but would have lost under GAAR. Related Appeals: DAMIS PROPERTIES INC. SABEL INVESTMENTS II-A LIMITED ZAGJO HOLDINGS LIMITED DEVAMM INVESTMENTS II-A LIMITED |

||

| 1091 | 2023-05-26 00:00:00 | Deans Knight Income Corporation | SCC | No. 39869 | https://scc-csc.ca/case-dossier/info/dock-regi-eng.aspx?cas=39869 | Burnet Duckworth & Palmer LLP | General Anti Avoidance Rule - GAAR, iNput Tax Credits | Allowed | Deans Knight Income Corporation v. Her Majesty The Queen | 2022-11-02 00:00:00 | 2014-10-24 00:00:00 | 2023-05-26 00:00:00 | Deans Knight Income Corp. v. Canada, 2023 SCC 16 | Pending Appeal | GAAR | Allowed | 1 | 0 | Yes | Rowe J. (Wagner C.J. and Karakatsanis, Martin, Kasirer, Jamal and O’Bonsawin JJ. concurring) | Côté J. | Attorney General of Canada | Burnet, Duckworth & Palmer | 1 | 0 | https://www.canlii.org/en/ca/scc/doc/2023/2023scc16/2023scc16.html?resultIndex=18&resultId=10ee8c2ddd424422937be6a49ce1783a&searchId=2024-05-12T16:06:42:334/8a29fffed21948edac9f9cca0b2cb8ad&searchUrlHash=AAAAAQA0Iml0YSAyNDUiIG9yICJHQUFSIiBvciAiR2VuZXJhbCBBbnRpLWF2b2lkYW5jZSBSdWxlIgAAAAAB | 2008 | 14.41 | 8.59 | |||||

| 1119 | 2022-06-30 00:00:00 | 3295940 Canada Inc. v. The Queen | TCC | 2017-4685(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=179709 | EY Cabinet d'avocats | General Anti Avoidance Rule - GAAR, Capital gain | Decision Received from Federal Court | 3295940 CANADA INC. AND HER MAJESTY THE QUEEN | 2020-09-08 00:00:00 | 2017-11-29 00:00:00 | 2022-06-30 00:00:00 | 2022 TCC I68 | Held in Abeyance | Series of transactions put in place to circumvent the application of subsection 55(2) of the Act through the inappropriate use of the CDA scheme to reduce the capital gain. | GAAR | Dismissed | 0 | 0 | Yes | The Honourable Justice Réal Favreau | Yanick Houle Sara Jahanbakhsh Dominic Bédard‐Lapointe | Roger Taylor Marie‐Claude Marcil Stéphanie Valois | 0 | 0 | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/520946/index.do?q=GAAR+or+%22General+anti-avoidance+rule%22 | ||||||||

| 1089 | 2022-04-01 00:00:00 | Magren Holdings Ltd. | TCC | 2017-486(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=175079 | Fillmore Riley LLP | Capital Dividend, General Anti Avoidance Rule - GAAR, Capital gain | Appealed to higher court | Magren Holdings Ltd. v. The Queen | 2019-02-11 00:00:00 | 2017-02-02 00:00:00 | 2021-12-06 00:00:00 | 2021 TCC 42 | Appealed to Higher Court | A series of transactions undertaken in order to artificially manufacture capital gains and offsetting capital losses leading to alleged additions to the capital dividend accounts and payment of non-taxable capital dividends to shareholders, including Grenon, See Ref 1113. | Part III Tax, Ineffective transactions sham, misrepresention | GAAR | Allowed | Allowed | 1 | 0 | Yes | Guy R. Smith | Ifeanyi Nwachukwu Tanis Halpape Christopher Kitchen Jeremy Tiger | Cy M. Fien Brandon Barnes Trickett Ari M. Hanson Aron W. Grusko | 1 | 0 | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/499411/index.do?q=Magren+Holdings+Ltd. | 2005 | 15.94 | 4.84 | Holding companies of James Grenon | ||

| 1075 | 2022-03-31 00:00:00 | David Herring | TCC | 2012-112(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=146147 | EY Cabinet d'avocats | Transfer of property | Closed | DAVID HERRING, KENNETH L. MILLEY, MARC HALFORD, THOMAS BREEN, GARRY INNANEN, LAURIE COGHLIN, SONNY GOLDSTEIN AND HER MAJESTY THE QUEEN | 2019-09-20 00:00:00 | 2012-01-03 00:00:00 | 2022-07-26 00:00:00 | 2022 TCC 41 | Dismissed | Leveraged donation program. | Donation | GAAR | Dismissed | No Finding | 1 | 0 | No | The Honourable Justice Guy R. Smith | Charles Camirand Dan Daniels | Terry McCaffrey Anahita Tajadod | 0 | 0 | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/520915/index.do?q=GAAR+or+%22General+anti-avoidance+rule%22 | 2002 | 19.58 | 10.57 | The Respondent had initially relied on the General Anti-Avoidance Rule pursuant to section 245 of the Act, but chose not to make any written submissions and accordingly, it will not be necessary to address that argument. | ||

| 1096 | 2021-12-03 00:00:00 | Loblaw Financial Holdings Inc. | SCC | 2015-2998(IT)G, 39220 | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=165554 | Osler, Hoskin & Harcourt LLP | Business Income | Dismissed | Loblaw Financial Holdings Inc. v. Canada | 2021-05-13 00:00:00 | July 2, 2015 | 2021-12-03 00:00:00 | 2021 SCC 51 | Dismissed | Whether income of a foreign affiliate is FAPI, or in the alternative, whether subject to GAAR. | FAPI | Dismissed | 0 | 0 | No | Côté J. (Wagner C.J. and Moldaver, Karakatsanis, Brown, Martin and Kasirer JJ. concurring) | Eric A. Noble and Elizabeth Chasson | Al Meghji and Pooja Mihailovich | 0 | 0 | https://scc-csc.lexum.com/scc-csc/scc-csc/en/item/19096/index.do | 2001 | 19.94 | 6.43 | A GAAR case with a FAPI ending. Since it was decided on the FAPI rules,but the GAAR was won at the TCC I still consider it a GAAR win for Taxpayer, see also the SCC Case in Brief https://www.scc-csc.ca/case-dossier/cb/2021/39220-eng.aspx | ||||

| 1089 | 2021-12-01 00:00:00 | James T. Grenon | TCC | 2014-4440(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=161840 | Fillmore Riley LLP | Costs | Appealed to Higher Court | JAMES T. GRENON v. HER MAJESTY THE QUEEN | Written | 2014-10-15 00:00:00 | 2021-12-01 00:00:00 | 2021 TCC 89 | Allowed | Costs | Allowed | Yes | The Honourable Justice Guy R. Smith | Ifeanyi Nwachukwu Tanis Halpape Christopher Kitchen Jeremy Tiger | Cy M. Fien Brandon Barnes Trickett Ari M. Hanson Aron W. Grusko John J. Tobin Linda Plumpton James Gotowiec | https://decisions.fca-caf.ca/tcc-cci/decisions/en/item/516992/index.do?q=GAAR+or+%22General+anti-avoidance+rule%22 | |||||||||||||

| 1093 | 2021-11-26 00:00:00 | Alta Energy Luxembourg S.A.R.L. | SCC | No. 39113 | https://scc-csc.ca/case-dossier/info/dock-regi-eng.aspx?cas=39113 | Thorsteinssons LLP | Capital gain from disposition of shares | Closed | Canada v. Alta Energy Luxembourg S.A.R.L. | 2021-03-19 00:00:00 | 2014-12-03 00:00:00 | 2021-11-26 00:00:00 | 2021 SCC 49 | Dismissed | Whether gain on sale of shares taxable. Immovaable Property siuated in Canada or Excluded Property, aletrnatively whether GAAR applies. | Article 13(4) Canada Luxembourg Treaty | GAAR | Dismissed | Dismissed | 0 | 1 | Yes | Abella, Moldaver, Karakatsanis, Côté, Brown, Kasirer | Rowe Martin Wagner | 0 | 1 | https://decisions.scc-csc.ca/scc-csc/scc-csc/en/item/19089/index.do | 2011 | 9.91 | 6.99 | ||||

| 1124 | 2021-10-01 00:00:00 | Robert Friesen | TCC | 2020-2090(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=193408 | Fillmore Riley LLP | General Anti Avoidance Rule - GAAR, Penalties and interests, Interest income earned on investments | Closed | 1970-01-01 00:00:00 | 2020-10-29 00:00:00 | 2021-10-01 00:00:00 | Consent Allowed Prior To Hearing | ||||||||||||||||||||||

| 1124 | 2021-10-01 00:00:00 | Blueshore Financial Credit Union | N/A | 2020-2077(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=193390 | Borden Ladner Gervais | General Anti Avoidance Rule - GAAR, Statute Barred, Interest income earned on investments | Closed | N/A | N/A | 2020-10-29 00:00:00 | 2021-10-01 00:00:00 | N/A | Consent allowed prior to hearing | ||||||||||||||||||||

| 1110 | 2021-09-16 00:00:00 | Computershare Trust Company of Canada as Trustee | N/A | 2017-969(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=175645 | Fasken Martineau DuMoulin LLP | General Anti Avoidance Rule - GAAR, Arrears Interest, Tax payable | Closed | N/A | N/A | February 13, 2017 | 2021-09-16 00:00:00 | N/A | Withdrawn | ||||||||||||||||||||

| 1109 | 2021-09-01 00:00:00 | Canadian Western Trust Company as Trustee of Self Directed RSP (ITF Ryan Ockey) (17880A) | N/A | 2017-476(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=175064 | Blake, Cassels & Graydon LLP | Tax payable, Arrears Interest, Unreported Income | Closed | N/A | N/A | 2017-02-02 00:00:00 | 2021-09-01 00:00:00 | N/A | Withdrawn | Related to Cardel Construction Ltd. | |||||||||||||||||||

| 1108 | 2021-09-01 00:00:00 | Damon Ockey (and Ryan Ockey) | N/A | 2017-501(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=175095 | Bennett Jones LLP | RRSP deduction, Shareholder benefits, General Anti Avoidance Rule - GAAR | Closed | N/A | N/A | January 27, 2017 | 2021-09-01 00:00:00 | N/A | Withdrawn | ||||||||||||||||||||

| 1091 | 2021-08-04 00:00:00 | Deans Knight Income Corporation | FCA | A-170-19 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Burnet Duckworth & Palmer LLP | General Anti Avoidance Rule - GAAR, iNput Tax Credits | Closed | Deans Knight Income Corporation v. The Queen | 2021-03-22 00:00:00 | October 24, 2014 | 2021-08-04 00:00:00 | 2021 FCA 160 | Allowed | The application of the general anti-avoidance rule (the GAAR) under the Income Tax Act, R.S.C. 1985, c. 1 (5th Supp.) (the Act) to a tax loss monetization arrangement. | GAAR | Allowed | 0 | 0 | Yes | WOODS J.A. STRATAS J.A. LASKIN J.A. | Perry Derksen Matthew Turnell Eric Brown Kiel Walker | Barry R. Crump Heather DiGregorio Julia Lisztwan | 0 | 0 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/501203/index.do?q=Deans+Knight | ||||||||

| 1105 | 2021-07-14 00:00:00 | Devamm Investments II-A Limited | TCC | 2016-4788(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=173731 | Dentons Canada LLP | Transfer of property s. 160(1), General Anti Avoidance Rule - GAAR | Decision Received from Federal Court | 2020-09-21 00:00:00 | November 7, 2016 | 2021-07-14 00:00:00 | 1970-01-01 00:00:00 | Adj. prior to hearing - Sine die | Consequences under section 160 of the ITA and under GAAR for transactions involving the sale of farmland in Brampton. | 160 Liability | GAAR | Allowed | Allowed | John R. Owen | Natalie Goulard Dominic Bédard-Lapointe Simon Vincent Alain Gareau | Yves St-Cyr Jacob Yau | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/500470/index.do?q=Damis+Properties | ||||||||||||

| 1105 | 2021-07-14 00:00:00 | Microbjo Properties Inc. | TCC | 2016-4789(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=173733 | Dentons Canada LLP | Transfer of property s. 160(1), General Anti Avoidance Rule - GAAR | Decision Received from Federal Court | 2020-09-21 00:00:00 | November 7, 2016 | 2021-07-14 00:00:00 | 1970-01-01 00:00:00 | Adj. prior to hearing - Sine die | Consequences under section 160 of the ITA and under GAAR for transactions involving the sale of farmland in Brampton. | 160 Liability | GAAR | Allowed | Allowed | John R. Owen | Natalie Goulard Dominic Bédard-Lapointe Simon Vincent Alain Gareau | Yves St-Cyr Jacob Yau | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/500470/index.do?q=Damis+Properties | ||||||||||||

| 1105 | 2021-07-14 00:00:00 | Sabel Investments II-A Limited | TCC | 2016-4785(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=173734 | Dentons Canada LLP | Transfer of property s. 160(1), General Anti Avoidance Rule - GAAR | Decision Received from Federal Court | 2020-09-21 00:00:00 | November 7, 2016 | 2021-07-14 00:00:00 | 1970-01-01 00:00:00 | Adj. prior to hearing - Sine die | Consequences under section 160 of the ITA and under GAAR for transactions involving the sale of farmland in Brampton. | 160 Liability | GAAR | Allowed | Allowed | John R. Owen | Natalie Goulard Dominic Bédard-Lapointe Simon Vincent Alain Gareau | Yves St-Cyr Jacob Yau | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/500470/index.do?q=Damis+Properties | ||||||||||||

| 1105 | 2021-07-14 00:00:00 | Zagjo Holdings Limited | TCC | 2016-4787(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=173739 | Dentons Canada LLP | Transfer of property s. 160(1), General Anti Avoidance Rule - GAAR | Decision Received from Federal Court | 2020-09-21 00:00:00 | November 7, 2016 | 2021-07-14 00:00:00 | 1970-01-01 00:00:00 | Adj. prior to hearing - Sine die | Consequences under section 160 of the ITA and under GAAR for transactions involving the sale of farmland in Brampton. | 160 Liability | GAAR | Allowed | Allowed | John R. Owen | Natalie Goulard Dominic Bédard-Lapointe Simon Vincent Alain Gareau | Yves St-Cyr Jacob Yau | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/500470/index.do?q=Damis+Properties | ||||||||||||

| 1105 | 2021-07-14 00:00:00 | Damis Properties Inc. | TCC | 2016-4783(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=173730 | Dentons Canada LLP | Transfer of property s. 160(1), General Anti Avoidance Rule - GAAR | Decision Received from Federal Court | Damis Properties Inc. v. The Queen | 1970-01-01 00:00:00 | November 7, 2016 | 2021-07-14 00:00:00 | 2021 TCC 44 | Allowed | Cost hearing | Costs | John R. Owen | Natalie Goulard Simon Vincent Dominic Bédard-Lapointe | Yves St-Cyr Jacob Yau | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/500470/index.do?q=Damis+Properties | ||||||||||||||

| 1089 | 2021-04-27 00:00:00 | James T. Grenon | TCC | 2014-4440(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=161840 | Fillmore Riley LLP | Non-Capital Losses, withdrawal from RRSP | Appealed to Higher Court | JAMES T. GRENON v. HER MAJESTY THE QUEEN | 2019-02-11 00:00:00 | 2014-10-15 00:00:00 | 2021-12-06 00:00:00 | 2021 TCC 30 | Allowed in part | Whether Income Funds were qualified investments for RRSP purposes or a sham, window dressing or whether GAAR should apply. | Qualified RRSP investments | Sham, Window Dressing or GAAR | Allowed in Part | Allowed | 0 | 1 | Yes | The Honourable Justice Guy R. Smith | Ifeanyi Nwachukwu Tanis Halpape Christopher Kitchen Jeremy Tiger | Cy M. Fien Brandon Barnes Trickett Ari M. Hanson Aron W. Grusko John J. Tobin Linda Plumpton James Gotowiec | 0 | 1 | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/495390/index.do?q=Grenon | 2004 | 16.94 | 7.15 | Appeal covers the 2004-2011 Taxation Years | ||

| 1104 | 2021-03-24 00:00:00 | Damis Properties Inc. | TCC | 2016-4783(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=173730 | Dentons Canada LLP | Transfer of property s. 160(1), General Anti Avoidance Rule - GAAR | Heard | Damis Properties Inc. v. The Queen | 2020-09-21 00:00:00 | November 7, 2016 | 2021-03-24 00:00:00 | 2021 TCC 44 | Allowed | Consequences under section 160 of the ITA and under GAAR for transactions involving the sale of farmland in Brampton. | 160 Liability | GAAR | Allowed | Allowed | 0 | 1 | Yes | John R. Owen | Natalie Goulard Dominic Bédard-Lapointe Simon Vincent Alain Gareau | Yves St-Cyr Jacob Yau | 0 | 1 | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/515550/index.do | ||||||

| 1099 | 2021-02-03 00:00:00 | The Bank of Montreal | TCC | 2016-445(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=168995 | Torys LLP | General Anti Avoidance Rule - GAAR, Capital loss | Decision Received from Federal Court | Bank of Montreal v. Queen | Written Submissions | 2016-02-09 00:00:00 | 2021-02-05 00:00:00 | 2021 TCC 3 | Costs | Costs | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/492415/index.do?q=The+Bank+of+Montreal | ||||||||||||||||||

| 1121 | 2021-01-05 00:00:00 | Canadian Imperial Bank of Commerce | N/A | 2018-1191(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=181245 | Osler, Hoskin & Harcourt LLP | Dividend Tax Refund, General Anti Avoidance Rule - GAAR | Closed | N/A | N/A | March 19, 2018 | 2021-01-05 00:00:00 | N/A | Withdrawal accepted prior to hearing | ||||||||||||||||||||

| 1100 | 2020-09-14 00:00:00 | Gladwin Realty Corporation | FCA | A-138-19 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Norton Rose Fulbright Canada S.E.N.C.R.L., s.r.l. | General Anti Avoidance Rule - GAAR | Closed | Gladwin Realty Corporation v. The Queen | 2020-06-08 00:00:00 | 2016-04-29 00:00:00 | 2020-09-14 00:00:00 | 2020 FCA 142 | Dismissed | Complex series of transaction to generate two capital gains and a loss, to allow a distribution of full capital dividend account. | GAAR | Dismissed | 1 | 0 | Yes | NOËL C.J. DE MONTIGNY J.A. LEBLANC J.A. | Nathalie Goulard Marie-France Camire Dominic BÉDARD-LAPOINTE | Wilfred Lefebvre Jonathan Lafrance | 1 | 0 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/485195/index.do?q=GAAR | 2008 | 11.71 | 4.38 | |||||

| 1116 | 2020-08-27 00:00:00 | Rogers Enterprises (2005) Inc.(Successor by Amalgamation to ESRIL (1998) Limited) | TCC | 2017-3617(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=178519 | Osler, Hoskin & Harcourt LLP | General Anti Avoidance Rule - GAAR | Closed | Rogers Enterprises (2015) INC. v. HER MAJESTY THE QUEEN | 2020-02-25 00:00:00 | September 6, 2017 | 2021-11-17 00:00:00 | 2020 TCC 92 | Allowed | Existence of Tax Benefit, Application of GAAR to Exempt Insurance Policy and Capital Dividend Account. | GAAR | Allowed | 0 | 1 | Yes | Don R. Sommerfeldt | Justine Malone Marie-Eve Aubry | Pooja Mihailovich Hemant Tilak | 0 | 1 | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/484573/index.do | 2009 | 11.89 | 4.2 | |||||

| 1106 | 2020-08-12 00:00:00 | MMV Capital Partners Inc. | TCC | 2016-5137(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=174120 | Deloitte Tax Law LLP | General Anti Avoidance Rule - GAAR, Non capital losses | Allowed | MMV Capital Partners Inc. v. The Queen | 2018-07-17 00:00:00 | December 1, 2016 | 2020-08-12 00:00:00 | 2020 TCC 82 | Allowed | Whether a misuse of loss use restriction rules in section 111. | GAAR | Allowed | 0 | 0 | Yes | Randall S. Bocock | Michael Taylor Matthew Turnell | David Muha Michael Collinge Kevin Chan | 0 | 0 | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/483788/index.do?q=GAAR | ||||||||

| 1097 | 2020-08-04 00:00:00 | The D Benning Family Trust | TCC | 2015-5618(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=168454 | McCarthy Tetrault LLP | General Anti Avoidance Rule - GAAR | Closed | N/A | N/A | 2015-12-22 00:00:00 | 2020-08-10 00:00:00 | `N/A | Consent allowed prior to hearing | ||||||||||||||||||||

| 1099 | 2020-05-04 00:00:00 | The Bank of Montreal | FCA | A-337-18 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Torys LLP | General Anti Avoidance Rule - GAAR, Capital loss | Dismissed | Canada v. Bank of Montreal | 2020-02-06 00:00:00 | 2016-02-09 00:00:00 | 2020-05-04 00:00:00 | 2020 FCA 82 | Dismissed | Whether foreign exchange losses available or subject to GAAR. | 39(2) | GAAR | Dismissed | No Finding | 0 | 1 | Yes | WEBB J.A. NEAR J.A. MACTAVISH J.A. | Natalie Goulard Sara Jahanbakhsh Marie-France Camiré | Martha MacDonald Jerald Wortsman Patrick Reynaud Angelo Nikolakakis (EY Law LLP) | 0 | 1 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/470301/index.do?q=GAAR | 2010 | 9.35 | 4.24 | |||

| 1096 | 2020-04-23 00:00:00 | Loblaw Financial Holdings Inc. | FCA | A-321-18 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Osler, Hoskin & Harcourt LLP | Business Income | Appealed to Higher Court | Loblaw Financial Holdings Inc. v. Canada | 2019-10-15 00:00:00 | July 2, 2015 | 2020-04-23 00:00:00 | 2020 FCA 79 | Appealed to Higher Court | Whether income of a foreign affiliate is FAPI, or in the alternative, whether subject to GAAR. | FAPI | Dismissed | Appealed | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/469751/index.do?q=2020+FCA+79 | |||||||||||||||

| 1076 | 2020-04-07 00:00:00 | George Markou | SCC | No. 39050 | https://scc-csc.ca/case-dossier/info/dock-regi-eng.aspx?cas=39050 | Davies Ward Phillips & Vineberg LLP | Charitable donations, General Anti Avoidance Rule - GAAR | Closed | George Markou, et. al. v. Her Majesty The Queen | Written | January 20, 2012 | 1970-01-01 00:00:00 | No. 39050 | Dismissed with Costs | https://decisions.scc-csc.ca/scc-csc/scc-l-csc-a/en/item/18360/index.do | |||||||||||||||||||

| 1093 | 2020-02-12 00:00:00 | Alta Energy Luxembourg S.A.R.L. | FCA | A-315-18 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Thorsteinssons LLP | Capital gain from disposition of shares | Decision Received from Federal Court | Canada v. Alta Energy Luxembourg S.A.R.L. | 2019-11-12 00:00:00 | December 3, 2014 | 2020-02-12 00:00:00 | 2020 FCA 43 | Appealed to Higher Court | Whether gain on sale of shares taxable. Immovaable Property siuated in Canada or Excluded Property, aletrnatively whether GAAR applies. | Article 13(4) Canada Luxembourg Treaty | GAAR | Dismissed | Dismissed | Appealed | Appealed | Yes | WEBB J.A. NEAR J.A. LOCKE J.A. | Natalie Goulard Christopher Bartlett Dominic Bédard-Lapointe | Matthew G. Williams E. Rebecca Potter | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/461326/index.do?q=gaar | Leave to Appeal to Surpreme Court Allowed | |||||||

| 1081 | 2020-01-23 00:00:00 | Univar Holdco Canada Ltd. | TCC | 2013-2834(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=154696 | Thorsteinssons LLP | General Anti Avoidance Rule - GAAR | Closed | Univar Holdco Canada Ltd. v. The Queen | Written | 2013-07-26 00:00:00 | 2021-02-09 00:00:00 | 2020 TCC 15 | Costs fixed | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/460271/index.do?q=2020+TCC+15 | |||||||||||||||||||

| 1076 | 2019-12-05 00:00:00 | George Markou | FCA | A-135-18 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Davies Ward Phillips & Vineberg LLP | Charitable donations, General Anti Avoidance Rule - GAAR | Decision Received from Federal Court | Markou v. The Queen | October 17, 2019 | January 20, 2012 | 2019-12-05 00:00:00 | 2019 FCA 299 | Dismissed | Leveraged donation program, whether entitled to deduction, whether GAAR appplies. | Donation tax credit. | GAAR | Dismissed | 1 | 0 | No | NOËL C.J. RIVOALEN J.A. LOCKE J.A. | Arnold H. Bornstein Hasan Junaid Jasmeen Mann | Guy Du Pont, Ad. E Michael H. Lubetsky Anne-Sophie Villeneuve | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/454020/index.do | 2001 | 17.94 | 7.88 | GAAR was not addressed at the FCA and GAAR was not addressed at the TCC, so this case has not been scored as a decision on GAAR. | |||||

| 1077 | 2019-11-14 00:00:00 | Birchcliff Energy Ltd. | SCC | No. 38761 | https://scc-csc.ca/case-dossier/info/dock-regi-eng.aspx?cas=38761 | PWC Law LLP | General Anti-Avoidance | Closed | Birchcliff Energy Ltd. v. Her Majesty The Queen | Written | 2012-03-13 00:00:00 | 2019-11-14 00:00:00 | No. 38761 | Dismissed | Leave to Appeal | https://decisions.scc-csc.ca/scc-csc/scc-l-csc-a/en/item/18030/index.do?q=Birchcliff | ||||||||||||||||||

| 1117 | 2019-05-23 00:00:00 | Electrolux Home Care Products Canada Inc. | N/A | 2017-4113(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=179093 | KPMG Law LLP | General Anti Avoidance Rule - GAAR | Withdrawal accepted prior to hearing | N/A | N/A | October 17, 2017 | 2019-05-23 00:00:00 | N/A | Withdrawn | Withdrawn, No Decision | 2004 | 14.4 | 1.6 | May 23, 2019 Withdrawal. | |||||||||||||||

| 1077 | 2019-05-16 00:00:00 | Birchcliff Energy Ltd. | FCA | A-396-17 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | PWC Law LLP | General Anti Avoidance Rule - GAAR | Closed | Birchcliff Energy Ltd. v. Canada | December 10, 2018 | 2012-03-13 00:00:00 | 2019-05-16 00:00:00 | 2019 FCA 151 | Dismissed | Seeding of predecessor to an amalgamation to avoid change of control restrictions and loss streaming rules, whether subject to GAAR. | GAAR | Dismissed | 1 | 0 | Yes | WEBB J.A. GAUTHIER J.A. STRATAS J.A. | Michael Taylor Neva Beckie | Patrick Lindsay Colin Bartlett | 1 | 0 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/405981/index.do?q=gaar | 2006 | 12.38 | 7.18 | |||||

| 1115 | 2019-04-10 00:00:00 | AGS Group Inc. | N/A | 2017-3102(IT)G | http://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=177958 | Felesky Flynn LLP | General Anti Avoidance Rule - GAAR, Capital loss | Closed | N/A | N/A | July 24, 2017 | 2019-04-15 00:00:00 | N/A | Withdrawal accepted prior to hearing | Withdrawn but do not know which taxation years. | |||||||||||||||||||

| 1091 | 2019-04-05 00:00:00 | Deans Knight Income Corporation | TCC | 2014-4148(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=161482 | Burnet Duckworth & Palmer LLP | General Anti Avoidance Rule - GAAR, iNput Tax Credits | Closed | Deans Knight Income Corporation v. The Queen | February 13, 2008 | October 24, 2014 | 2021-08-25 00:00:00 | 2019 TCC 76 | Allowed | Whether an acquisition of control of a lossco occurred and if not whether the GAAR applies. | 251 | GAAR | Allowed | Allowed | Appealed | Appealed | Yes | Brent Paris | Robert Carvalho Perry Derksen Shannon Currie | J. Kelly Hannan Heather DiGregorio Darian Khan | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/367585/index.do?q=gaar | ||||||||

| 1100 | 2019-03-21 00:00:00 | Gladwin Realty Corporation | TCC | 2016-1733(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=170356 | Norton Rose Fulbright Canada S.E.N.C.R.L., s.r.l. | General Anti Avoidance Rule - GAAR | Closed | Gladwin Realty Corporation v. The Queen | January 23, 2019 | 2016-04-29 00:00:00 | 2021-06-29 00:00:00 | 2019 TCC 62 | Appealed to Higher Court | Complex series of transaction to generate two capital gains, to allow a distribution of full capital dividend account. | GAAR | Dismissed | Appealed | Appealed | Yes | Robert J. Hogan | Marie-France Camiré Natalie Goulard Dominic Bédard-Lapointe | Wilfrid Lefebvre Jonathan Lafrance | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/365737/index.do?q=gaar | ||||||||||

| 1092 | 2019-01-30 00:00:00 | Madison Pacific Properties | FCA | A-172-17 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Thorsteinssons LLP | Capital loss, General Anti Avoidance Rule - GAAR | Scheduled | Madison Pacific Properties Inc. v. Canada | 2018-11-07 00:00:00 | 2014-11-03 00:00:00 | 2019-01-30 00:00:00 | 2019 FCA 19 | Dismissed | Procedural Motion - documents to be provided to CRA | Procedural Motion | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/361863/index.do?q=A-172-17 | |||||||||||||||||

| 1101 | 2019-01-18 00:00:00 | Jencal Holdings Ltd. | TCC | 2016-3757(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=172649 | KPMG Law LLP | Business Income | Closed | Jencal Holdings Ltd. v. The Queen | October 24, 2018 | September 13, 2016 | 2019-07-22 00:00:00 | 2019 TCC 16 | Allowed | Whether 256(2.1) applies to limit the small business deduction or whether the GAAR applies. | 256(2.1) | GAAR | Dismissed | No Finding | 0 | 0 | No | David E. Graham | Whitney Dunn Lisa Macdonell | Michel Bourque Jacqueline A. Fehr | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/361595/index.do?q=gaar | 2012 | 6.56 | 2.85 | There is no finding on the GAAR in this case and so it is not a decision on GAAR | ||||

| 1096 | 2018-12-20 00:00:00 | Loblaw Financial Holdings Inc. | TCC | 2015-2998(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=165554 | Osler, Hoskin & Harcourt LLP | Business Income | Closed | Loblaw Financial Holdings Inc. v. The Queen | N/A | July 2, 2015 | 2021-11-04 00:00:00 | 2018 TCC 263 | Costs fixed | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/356540/index.do?q=2018+TCC+263 | |||||||||||||||||||

| 1073 | 2018-12-13 00:00:00 | Oxford Properties Group Inc. | SCC | No. 38049 | https://scc-csc.ca/case-dossier/info/dock-regi-eng.aspx?cas=38049 | Osler, Hoskin & Harcourt LLP | General Anti Avoidance Rule - GAAR | Closed | Oxford Properties Group Inc. v. Her Majesty The Queen | Written | 2011-11-17 00:00:00 | 2018-12-13 00:00:00 | No. 38049 | Dismissed with Costs | Leave to Appeal | https://decisions.scc-csc.ca/scc-csc/scc-l-csc-a/en/item/17408/index.do?q=Oxford+Properties | ||||||||||||||||||

| 1093 | 2018-11-22 00:00:00 | Alta Energy Luxembourg S.A.R.L. | TCC | 2014-4359(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=161738 | Thorsteinssons LLP | Costs | Decision Received from Federal Court | Alta Energy Luxembourg S.A.R.L. v. The Queen | N/A | December 3, 2014 | 2021-02-23 00:00:00 | 2018 TCC 235 | Costs fixed | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/350958/index.do?q=2018+TCC+235 | |||||||||||||||||||

| 1107 | 2018-11-19 00:00:00 | Sean Aylward | N/A | 2017-318(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=174906 | Osler, Hoskin & Harcourt LLP | Charitable donations, General Anti Avoidance Rule - GAAR, Statute Barred | Closed | N/A | N/A | December 16, 2016 | 2018-11-26 00:00:00 | N/A | Withdrawal accepted prior to hearing | Withdrawn but do not know which taxation years. | |||||||||||||||||||

| 1065 | 2018-11-15 00:00:00 | 2763478 Canada Inc | FCA | A-243-17 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Gowlings WLG (Canada) S.E.N.C.R.L., s.r.l. | Capital gain from disposition of shares | Closed | 2763478 Canada Inc. v. Canada | October 4, 2018 | 2009-12-17 00:00:00 | 2018-11-15 00:00:00 | 2018 FCA 209 | Dismissed | Application of the GAAR to a value shift to move cost base. | GAAR | Dismissed | 1 | 0 | Yes | NOËL C.J. BOIVIN J.A. DE MONTIGNY J.A. | Justine Malone | Serge Amar Guy Régimbald | 1 | 0 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/350070/index.do?q=gaar | 2005 | 12.88 | 8.92 | |||||

| 1095 | 2018-10-25 00:00:00 | Iggillis Holdings Inc. | SCC | No. 38103 | https://scc-csc.ca/case-dossier/info/dock-regi-eng.aspx?cas=38103 | Dentons Canada LLP | Common interest Privilege | Closed | Minister of National Revenue v. Iggillis Holdings Inc. | Written | 2015-01-28 00:00:00 | 2018-10-25 00:00:00 | No. 38103 | Dismissed with Costs | https://decisions.scc-csc.ca/scc-csc/scc-l-csc-a/en/item/17322/index.do | 2007 | 10.82 | 3.74 | ||||||||||||||||

| 1086 | 2018-09-20 00:00:00 | 594710 British Columbia Ltd. | FCA | A-20-17 | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Thorsteinssons LLP | General Anti Avoidance Rule - GAAR | Appealed to Higher Court | Canada v. 594710 British Columbia Ltd. | May 9, 2016 | October 25, 2013 | 2018-09-20 00:00:00 | 2018 FCA 166 | Allowed | Whether GAAR applies to a reverse loss trading transaction. A case straddling "Astute" versus "Abusive" tax planning. | GAAR | Allowed | 1 | 0 | Yes | WOODS J.A. DAWSON J.A. GLEASON J.A. | Perry Derksen Whitney Dunn Spencer Landsiedel | Steven Cook Matthew Williams S. Natasha Reid | 1 | 0 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/344715/index.do?q=gaar | 2006 | 11.73 | 4.91 | |||||

| 1099 | 2018-09-12 00:00:00 | The Bank of Montreal | TCC | 2016-445(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=168995 | Torys LLP | General Anti Avoidance Rule - GAAR, Capital loss | Appealed to Higher Court | Bank of Montreal v. Queen | June 4, 2018 | February 9, 2016 | 2021-02-05 00:00:00 | 2018 TCC 187 | Appealed to Higher Court | Whether foreign exchange losses available or subject to GAAR. | 39(2) | GAAR | Allowed | Allowed | Appealed | Appealed | Yes | David E. Graham | Natalie Goulard Sara Jahanbakhsh Marie-France Camiré | Martha MacDonald Jerald Wortsman Patrick Reynaud | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/344337/index.do?q=gaar | ||||||||

| 1096 | 2018-09-07 00:00:00 | Loblaw Financial Holdings Inc. | TCC | 2015-2998(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=165554 | Osler, Hoskin & Harcourt LLP | Business Income | Appealed to Higher Court | Loblaw Financial Holdings Inc. v. The Queen | April 23, 2018 | July 2, 2015 | 2021-11-04 00:00:00 | 2018 TCC 182 | Appealed to Higher Court | Whether income of a foreign affiliate is FAPI, or in the alternative, whether subject to GAAR. | FAPI | GAAR | Dismissed | Allowed | Appealed | Appealed | Yes | Campbell J. Miller | Elizabeth Chasson, Isida Ranxi, Aleksandrs Zemdegs, Gary Edwards, Laurent Bartleman, Cherylyn Dickson | Mary Paterson, Mark Sheeley, Pooja Mihailovich, Al Meghji, Lipi Mishra | 0 | 1 | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/344040/index.do?q=gaar | ||||||

| 1103 | 2018-08-23 00:00:00 | Keurig Canada Inc. | N/A | 2016-4308(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=173232 | Stikeman Elliott LLP | General Anti Avoidance Rule - GAAR | Closed | N/A | N/A | October 11, 2016 | 2018-09-06 00:00:00 | N/A | Withdrawal accepted prior to hearing | ||||||||||||||||||||

| 1093 | 2018-08-22 00:00:00 | Alta Energy Luxembourg S.A.R.L. | TCC | 2014-4359(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=161738 | Thorsteinssons LLP | Capital gain from disposition of shares | Decision Received from Federal Court | Alta Energy Luxembourg S.A.R.L. v. The Queen | June 11, 2018 | December 3, 2014 | 2021-02-23 00:00:00 | 2018 TCC 152 | Appealed to Higher Court | Whether gain on sale of shares taxable. Immovaable Property siuated in Canada or Excluded Property, aletrnatively whether GAAR applies. | Article 13(4) Canada Luxembourg Treaty | GAAR | Allowed | Allowed | Appealed | Appealed | Yes | Robert J. Hogan | Patricia Lee Christopher M. Bartlett | Warren J.A. Mitchell, Q.C. Matthew G. Williams E. Rebecca Potter | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/336305/index.do?q=gaar | ||||||||

| 1088 | 2018-07-20 00:00:00 | Quinco Financial Inc. | FCA | A-352-16 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Felesky Flynn LLP | Jurisdiction issue, General Anti Avoidance Rule - GAAR | Closed | Quinco Financial Inc. v. Canada | June 12, 2018 | 2014-05-08 00:00:00 | 2018-07-20 00:00:00 | 2018 FCA 137 | Dismissed | Date on which interest begins to accumulate on a GAAR reassessment under 157(1). | GAAR | Dismissed | 1 | 0 | No | WEBB J.A. STRATAS J.A. LASKIN J.A. | Justine Malone | Ken S. Skingle, Q.C. D. Brett Anderson | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/316264/index.do?q=gaar | 2004 | 13.56 | 4.2 | Since GAAR was not at issue in the decision just the timing of interest, it is not a GAAR win, but it should be a crown win. | ||||||

| 1087 | 2018-06-29 00:00:00 | Pierre Pomerleau | FCA | A-456-16 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | EY Cabinets d'avocats s.r.l./S.E.N.C.R.L. | Shareholder Benefits | Appealed to Higher Court | Pomerleau v. Canada | June 29, 2018 | January 29, 2014 | 2018-06-29 00:00:00 | 2018 FCA 129 | Dismissed | Does GAAR apply to a true inter-generational transfer as a gift and not as an accommodation to surplus strip. That is where 84.1 does not apply. | GAAR | Dismissed | 1 | 0 | Yes | NOËL C.J. BOIVIN J.A. DE MONTIGNY J.A. | Nathalie Goulard | Angelo Nikolakakis Rachel Robert Maude Lussier-Bourque | 1 | 0 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/312119/index.do?q=gaar | 2005 | 12.5 | 4.42 | |||||

| 1083 | 2018-06-08 00:00:00 | Wild and 1245989 Alberta Ltd. | FCA | A-142-17 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Thompson Dorfman Sweatman LLP | Shareholder Benefits | Decision Received from Federal Court | 1245989 Alberta Ltd. v. Canada (Attorney General) | April 12, 2018 | 2013-08-07 00:00:00 | 2018-06-08 00:00:00 | 2018 FCA 114 | Allowed | Series of reorganizations to increase the PUC of shares of a corporation. | GAAR | Allowed | 0 | 1 | Yes | DAWSON J.A. NADON J.A. GLEASON J.A. | Margaret M. McCabe Justine Malone | Jeff D. Pniowsky Samantha Holloway | 0 | 1 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/311065/index.do?q=gaar | 2007 | 10.44 | 4.84 | |||||

| 1102 | 2018-04-30 00:00:00 | Smith Family Trust (2001) | TCC | 2016-4104(IT)G | http://cas-cdc-www02.cas-satj.gc.ca/tcc_docket/search_e.php?ap_id=173019 | McInnes Cooper | General Anti Avoidance Rule - GAAR, Penalties and Interests, income from dividends, income tax avoidance. | Closed | HLB Smith Holdings Limited v. The Queen | 2017-12-06 00:00:00 | October 4, 2016 | 2018-08-24 00:00:00 | 2018 TCC 83 | Dismissed | Payments of dividends and an insolvent company. | 160 | Dismissed | 0 | 0 | No | Steve D'arcy | Stan W. McDonald | Brian K. Awad | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/309700/index.do?q=Smith+family+trust | 2008 | 9.65 | 1.89 | GAAR Never pleaded | ||||||

| 1090 | 2018-04-10 00:00:00 | Fiducie financière Satoma | FCA | A-189-17 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Norton Rose Fulbright Canada S.E.N.C.R.L., s.r.l. | Income from dividends | Closed | Fiducie financière Satoma v. Canada | February 14, 2018 | 2014-10-21 00:00:00 | 2018-04-10 00:00:00 | 2018 FCA 74 | Dismissed | Applicationof GAAR where specific anti-avoidance rule triggered deliberately. | GAAR | Dismissed | 1 | 0 | Yes | NOËL C.J. PELLETIER J.A. DE MONTIGNY J.A. | Nathalie Goulard Sara Jahanbakhsh | Wilfrid Lefebvre, QC Vincent Dionne | 1 | 0 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/308508/index.do?q=gaar | 2005 | 12.28 | 3.47 | |||||

| 1076 | 2018-04-09 00:00:00 | George Markou | TCC | 2012-423(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=146470 | Davies Ward Phillips & Vineberg LLP | Charitable donations, General Anti Avoidance Rule - GAAR | Closed | Markou v. The Queen | October 10, 2017 | January 20, 2012 | 2021-02-10 00:00:00 | 2018 TCC 66 | Appealed to Higher Court | Leveraged donation program, whether entitled to deduction, whether GAAR appplies. | Donation tax credit. | GAAR | Dismissed | No Finding | Appealed | Appealed | No | Brent Paris | Arnold Bornstein John Grant Lorraine Edinboro | Guy Du Pont, Ad.E. Michael H. Lubetsky Reuben Abitbol | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/308663/index.do?q=gaar | ||||||||

| 1095 | 2018-03-06 00:00:00 | Iggillis Holdings Inc. | FCA | A-465-16 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Dentons Canada LLP | Common interest Privilege | Closed | Iggillis Holdings Inc. v. Canada (National Revenue) | 2017-10-02 00:00:00 | 2015-01-28 00:00:00 | 2018-03-06 00:00:00 | 2018 FCA 51 | Allowed | Procedural Motion - Whether Common Interest Privilege exists on transaction memo disclosed in an M&A due Diligence. | Procedural Motion | Allowed | 0 | 1 | No | Margaret McCabe Henry Gluch | Joel Nitikman | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/306994/index.do?q=2018+FCA+51 | |||||||||||

| 1073 | 2018-02-01 00:00:00 | Oxford Properties Group Inc. | FCA | A-399-16 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Osler, Hoskin & Harcourt LLP | General Anti Avoidance Rule - GAAR | Closed | Canada v. Oxford Properties Group Inc. | December 11, 2017 | 2011-11-17 00:00:00 | 2018-02-01 00:00:00 | 2018 FCA 30 | Allowed | Packaged sale of real estate assets via partnership to bump basis in sale to tax exempt entities. | GAAR | Allowed | 1 | 0 | Yes | NOËL C.J. DAWSON J.A. RENNIE J.A. | Robert Carvalho Perry Derksen | Al Meghji Jack Silverson Pooja Mihailovich | 1 | 0 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/307178/index.do?q=gaar | 2006 | 11.1 | 6.21 | |||||

| 1066 | 2018-01-09 00:00:00 | Guy Gervais | FCA | A-392-16 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | BCF s.e.r.c.r.l. | General Anti Avoidance Rule - GAAR | Closed | Gervais v. Canada | November 14, 2017 | January 7, 2010 | 2018-01-09 00:00:00 | 2018 FCA 3 | Dismissed | Small business capital gains duplication with spouse, directed by FCA to revisit GAAR. | GAAR | Dismissed | 1 | 0 | Yes | NOËL GAUTHIER DE MONTIGNY | Josée Tremblay Mélanie Sauriol | Serge Fournier | 1 | 0 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/304655/index.do?q=gaar | 2002 | 15.04 | 8.01 | |||||

| 1077 | 2017-11-24 00:00:00 | Birchcliff Energy Ltd. | TCC | 2012-1087(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=147165 | PWC Law LLP | General Anti Avoidance Rule - GAAR | Closed | Birchcliff Energy Ltd. v. The Queen | May 4, 2017 | 2012-03-13 00:00:00 | 2019-08-21 00:00:00 | 2017 TCC 234 | Appealed to Higher Court | Seeding of predecessor to an amalgamation to avoid change of control restrictions and loss streaming rules, whether 256(7) applies, whether a sham and whether subject to GAAR. | 256(7)/Sham | GAAR | Dismissed | Allowed | Appealed | Appealed | Yes | Jorré | Robert Carvalho Neva Beckie Jonathan Wittig | Patrick Lindsay Jean-Philippe Couture | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/301673/index.do?q=gaar | ||||||||

| 1081 | October 13, 2017 | Univar Holdco Canada Ltd. | FCA | A-245-16 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Thorsteinssons LLP | General Anti Avoidance Rule - GAAR | Decision Received from Federal Court | Univar Holdco Canada Ltd. v. The Queen | May 10, 2017 | 2013-07-26 00:00:00 | October 13, 2017 | 2017 FCA 207 | Allowed | Whether transactions to reorganize Canadian group of companies to fit exemption from212.1. | GAAR | Allowed | 0 | 1 | Yes | Pelletier Webb Near | Ronald MacPhee Vincent Bourgeois | Matthew G. Williams Michael W. Colborne | 0 | 1 | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/235963/index.do | 2007 | 9.79 | 4.22 | |||||

| 1084 | 2017-09-08 00:00:00 | Lynn Cassan | TCC | 2013-355(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=152031 | Osler, Hoskin & Harcourt LLP | Interest Expense, Partnership Interest LP Losses | Appealed to Higher Court | Cassan v. The Queen | June 6, 2016 | 2013-09-20 00:00:00 | 2017-10-24 00:00:00 | 2017 TCC 174 | Allowed | Whether taxpayers entitled to a deduction for interest and a non-refundable tax credit in complex loan donation scheme. | Donation tax credit, interest deductibility. | GAAR | Allowed | 0 | 1 | No | John R. Owen | Daniel Bourgeois, Andrew Miller Josh Kumar | Al Meghji, Mary Paterson, Pooja Mihailovich Adam Hirsh | 0 | 0 | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/234811/index.do?q=gaar | 2009 | 7.82 | 4.1 | No decision on GAAR so no score, but leave time in. | |||

| 1090 | 2017-06-01 00:00:00 | Fiducie Financière Satoma | TCC | 2014-3800(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=161104 | Norton Rose Fulbright Canada S.E.N.C.R.L., s.r.l. | Income from dividends | Closed | Fiducie Financière Satoma c. La Reine | October 27, 2016 | 2014-10-21 00:00:00 | 2019-03-05 00:00:00 | 2017 TCC 84 | Appealed to Higher Court | Applicationof GAAR where specific anti-avoidance rule triggered deliberately. | GAAR | Dismissed | Appealed | Appealed | Yes | Lucie Lamarre | Natalie Goulard Me Sara Jahanbakhsh | Vincent Dionne Wilfrid Lefebvre | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/231656/index.do?q=2017+TCC+84 | 2005 | 13.18 | 4.37 | |||||||

| 1065 | June 1, 2017 | 2763478 Canada Inc. | TCC | 2009-3842(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=137193 | Gowlings WLG (Canada) S.E.N.C.R.L., s.r.l. | Capital gain from disposition of shares | Appealed to Higher Court | 2763478 Canada Inc. c. La Reine | May 18, 2016 | 2009-12-17 00:00:00 | Deptember 28, 2020 | 2017 TCC 98 | Appealed to Higher Court | Application of the GAAR to a value shift to move cost base. | GAAR | Dismissed | Appealed | Appealed | Yes | Brent Paris | Andrew Miller Justine Malone | Serge Amar Marie-Hélène Tremblay | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/231704/index.do?q=gaar | ||||||||||

| 1085 | 2017-05-18 00:00:00 | MP Western Properties | TCC | 2013-3885(IT)G | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Thorsteinssons LLP | Non capital losses, Scientific research & development expenses, General Anti Avoidance Rule - GAAR | Heard | MP Western Properties v. The Queen | 2016-11-17 00:00:00 | 2013-10-10 00:00:00 | 1970-01-01 00:00:00 | 2017 TCC 82 | Allowed | Prcedural Motion to comple the production of documents. | Procedural Motion | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/231280/index.do | |||||||||||||||||

| 1077 | 2017-04-28 00:00:00 | Birchcliff Energy Ltd. | FCA | A-472-15 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | PWC Law LLP | General Anti Avoidance Rule - GAAR | Closed | Birchcliff Energy Ltd. v. Canada | 2017-01-30 00:00:00 | 2012-03-13 00:00:00 | 2017-04-28 00:00:00 | 2017 FCA 89 | Allowed | Identity of judge | Allowed | WEBB J.A. SCOTT J.A. | STRATAS | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/230476/index.do?q=2017+FCA+89 | |||||||||||||||

| 1083 | 2017-03-31 00:00:00 | Wild and 1245989 Alberta Ltd. | TCC | 2013-3907(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=155836 | Thompson Dorfman Sweatman LLP | Shareholder Benefits | Appealed to Higher Court | 1245989 Alberta Ltd. v. The Queen | January 16, 2016 | 2013-08-07 00:00:00 | 2018-06-18 00:00:00 | 2017 TCC 51 | Appealed to Higher Court | Series of reorganizations to increase the PUC of shares of a corporation. | GAAR | Dismissed | Appealed | Appealed | Yes | K. Lyons | Margaret McCabe Justine Malone | Jeff D. Pniowsky | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/229679/index.do?q=gaar | 2007 | 10.47 | 4.87 | |||||||

| 1086 | 2016-12-15 00:00:00 | 594710 British Columbia Ltd. | TCC | 2013-4033(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=155973 | Thorsteinssons LLP | General Anti Avoidance Rule - GAAR | Appealed to Higher Court | 594710 British Columbia Ltd. v. The Queen | May 9, 2016 | 2013-10-25 00:00:00 | 2019-05-23 00:00:00 | 2016 TCC 288 | Appealed to Higher Court | Whether GAAR applies to a reverse loss trading transaction. A case straddling "Astute" versus "Abusive" tax planning. | GAAR | Allowed | Appealed | Appealed | Yes | Eugene P. Rossiter | Robert Carvalho Perry Derksen Whitney Dunn | Steven Cook S. Natasha Reid | http://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/214313/index.do?r=AAAAAQA5ImdlbmVyYWwgYW50aSBhdm9pZGFuY2UgcnVsZSIgb3IgZ2FhciBvciAiMjQ1KDIpIiBvciByZ2FlAQ | 2006 | 12.4 | 5.58 | |||||||

| 1095 | 2016-12-07 00:00:00 | Iggillis Holdings Inc. | FC | T-126-15 | N/A | Felesky Flynn LLP | Common Interest Privilege | Closed | Iggillis Holdings Inc. v. Canada (National Revenue) | 2016-05-03 00:00:00 | 2015-01-28 00:00:00 | 2016-12-07 00:00:00 | 2016 FC 1352 | Allowed | Procedural Motion - Whether Common Interest Privilege exists on transaction memo disclosed in an M&A due Diligence. | Procedural Motion | Allowed | Appealed | Appealed | No | Peter Annis | Margaret McCabe | Jon Gilbert Joel Nitikman for the Intervenor | http://decisions.fca-caf.gc.ca/fc-cf/decisions/en/item/212904/index.do?r=AAAAAQA5ImdlbmVyYWwgYW50aSBhdm9pZGFuY2UgcnVsZSIgb3IgZ2FhciBvciAiMjQ1KDIpIiBvciByZ2FlAQ | Procedural motion so no gaar finding | |||||||||

| 1080 | 2016-11-16 00:00:00 | Paul C. Golini | TCC | 2013-705(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=152394 | PWC Law LLP | Statute Barred and GAAR | Closed | Golini v. The Queen | Written | 2013-02-25 00:00:00 | 2019-07-31 00:00:00 | 2016 TCC 247 | Costs fixed | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/181784/index.do | |||||||||||||||||||

| 1087 | 2016-11-10 00:00:00 | Pierre Pomerleau | TCC | 2014-517(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=157471 | EY Cabinets d'avocats s.r.l./S.E.N.C.R.L. | Shareholder Benefits | Appealed to Higher Court | Pomerleau c. La Reine | June 6, 2016 | 2014-01-29 00:00:00 | 2019-07-31 00:00:00 | 2016 CCI 228 | Appealed to Higher Court | Does GAAR apply to a true inter-generational transfer as a gift and not as an accommodation to surplus strip. That is where 84.1 does not apply. | GAAR | Dismissed | Appealed | Appealed | Yes | Réal Favreau | Natalie Goulard | Angelo Nikolakakis Louis Tassé | http://decisions.fca-caf.gc.ca/tcc-cci/decisions/fr/item/182338/index.do?r=AAAAAQA5ImdlbmVyYWwgYW50aSBhdm9pZGFuY2UgcnVsZSIgb3IgZ2FhciBvciAiMjQ1KDIpIiBvciByZ2FlAQ | ||||||||||

| 1082 | 2016-09-29 00:00:00 | Superior Plus Corp. | TCC | 2013-2939(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=154806 | Osler, Hoskin & Harcourt LLP | Non Capital Losses | Closed | Superior Plus Corp. v. The Queen | May 30, 2016 | 2013-08-07 00:00:00 | 2018-04-26 00:00:00 | 2016 TCC 217 | Withdrawn | Procedural motion on seeking the true policy underpinning GAAR assessment. | Procedural Motion | Allowed | No | Robert James Hogan | Raj Grewal Perry Derksen Kristian DeJong | Al Meghji Edward Rowe Joanne Vandale | http://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/180772/index.do | 2010 | 7.32 | 4.72 | Withdrawn so no GAAR finding but duration left in Years meausurement. Withdrawn Octiober 17, 2017. | ||||||||

| 1073 | 2016-09-19 00:00:00 | Oxford Properties Group Inc. | TCC | 2011-3616(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=145468 | Osler, Hoskin & Harcourt LLP | General Anti Avoidance Rule - GAAR | Closed | Oxford Properties Group Inc. v. The Queen | February 2, 2015 | 2011-11-17 00:00:00 | 2018-10-06 00:00:00 | 2016 TCC 204 | Appealed to Higher Court | Packaged sale of real estate assets via partnership to bump basis in sale to tax exempt entities. | 245(1) | Allowed | Appealed | Appealed | Yes | Steven K. D'Arcy | Robert Carvalho Perry Derksen | Al Meghji Jack Silverson Pooja Mihailovich | http://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/180481/index.do?r=AAAAAQAGb3hmb3JkAQ | ||||||||||

| 1066 | 2016-09-12 00:00:00 | Guy Gervais | TCC | 2010-71(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=137421 | BCF s.e.r.c.r.l. | General Anti Avoidance Rule - GAAR | Closed | Gervais c. La Reine | March 31, 2016 | 2010-01-07 00:00:00 | 2018-08-09 00:00:00 | 2016 TCC 180 | Appealed to Higher Court | Small business capital gains duplication with spouse, directed by FCA to revisit GAAR. | 245(1) | Dismissed | Appealed | Appealed | Yes | Gaston Jorré | Mélanie Sauriol Josée Tremblay | Serge Fournier Camille Janvier | http://decisions.fca-caf.gc.ca/tcc-cci/decisions/fr/item/180239/index.do?r=AAAAAQA5R0FBUiBvciAiMjQ1KDIpIiBvciBSR0FFIG9yICJHZW5lcmFsIGFudGktYXZvaWRhbmNlIHJ1bGUiAQ | ||||||||||

| 1088 | 2016-09-01 00:00:00 | Quinco Financial Inc | TCC | 2014-1744(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=158862 | Felesky Flynn LLP | Jurisdiction issue, General Anti Avoidance Rule - GAAR | Closed | Quinco Financial Inc v. The Queen | February 29, 2016 | 2014-05-08 00:00:00 | 2019-12-02 00:00:00 | 2016 TCC 190 | Appealed to Higher Court | Date on which interest begins to accumulate on a GAAR reassessment. | 157(1) | Dismissed | Appealed | Appealed | No | Randall S. Bocock | Rosemary Fincham Shubir (Shane) Aikat | Ken Skingle Dan Morrison | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/180708/index.do | ||||||||||

| 1080 | 2016-07-19 00:00:00 | Paul C. Golini | TCC | 2013-705(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=152394 | PWC Law LLP | Statute Barred and GAAR | Closed | Golini v. The Queen | November 2, 2015 | 2013-02-25 00:00:00 | 2019-07-31 00:00:00 | 2016 TCC 174 | Dismissed | Complex series of transactions involving loans and insurance. | 15(1) | GAAR | Dismissed | Denied | 1 | 0 | Yes | Campbell J. Miller | Jenna Clark Christa Akey Alisa Apostle | Nathalie Goyette Geneviève Léveillé Laurie Beausoleil | 1 | 0 | http://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/168728/index.do?r=AAAAAQA5R0FBUiBvciAiMjQ1KDIpIiBvciBSR0FFIG9yICJHZW5lcmFsIGFudGktYXZvaWRhbmNlIHJ1bGUiAQ | 2008 | 10.59 | 6.43 | While assessed under 15(1), there is a finding of abuse under the GAAR, so I have scored it a GAAR win for the crown. | ||

| 1081 | 2016-06-22 00:00:00 | Univar Holdco Canada ULC | TCC | 2013-2834(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=154696 | Thorsteinssons LLP | General Anti Avoidance Rule - GAAR | Heard | Univar Holdco Canada ULC v. The Queen | June 8, 2015 | 2013-07-26 00:00:00 | 2021-02-09 00:00:00 | 2016 TCC 159 | Appealed to Higher Court | Transactions were arranged to circumvent the application of the anti-avoidance rule in section 212.1 and to take advantage of the relieving exemption found in subsection 212.1(4) of the Act. GAAR Applied. | 245(1) | Dismissed | Appealed | Appealed | Yes | Valerie Miller | Ronald MacPhee Tamara Watters | Matthew G. Williams Michael Colborne | http://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/145671/index.do?r=AAAAAQA5R0FBUiBvciAiMjQ1KDIpIiBvciBSR0FFIG9yICJHZW5lcmFsIGFudGktYXZvaWRhbmNlIHJ1bGUiAQ | ||||||||||

| 1076 | 2016-06-01 00:00:00 | George Markou | TCC | 2012-423(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=146470 | Davies Ward Phillips & Vineberg LLP | Charitable donations, General Anti Avoidance Rule - GAAR | Closed | Markou v. The Queen | 2016-05-05 00:00:00 | January 20, 2012 | 2021-02-10 00:00:00 | 2016 TCC 137 | Allowed | https://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/144656/index.do?q=2016+TCC+137 | |||||||||||||||||||

| 1066 | 2016-01-06 00:00:00 | Guy Gervais | FCA | A-416-14 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | BCF s.e.r.c.r.l. | General Anti Avoidance Rule - GAAR | Closed | Canada v. Gervais | October 7, 2015 | 2010-01-07 00:00:00 | 1970-01-01 00:00:00 | 2016 FCA 1 | Appealed to Higher Court | Capital gains exemption planning. Appeal allowed on TCC decision but sent back to TCC to consider the GAAR. | 47(1) | Allowed | Appealed | Appealed | No | Richard Boivin Marc Nadon Yves de Montigny | Josée Tremblay Mélanie Sauriol | Serge Fournier | http://decisions.fca-caf.gc.ca/fca-caf/decisions/fr/item/127518/index.do?r=AAAAAQA5R0FBUiBvciAiMjQ1KDIpIiBvciBSR0FFIG9yICJHZW5lcmFsIGFudGktYXZvaWRhbmNlIHJ1bGUiAQ | ||||||||||

| 1082 | 2015-11-03 00:00:00 | Superior Plus Corp. | FCA | A-267-15 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Osler, Hoskin & Harcourt LLP | Non Capital Losses | Closed | Canada v. Superior Plus Corp. | November 3, 2015 | 2013-08-07 00:00:00 | 2015-11-03 00:00:00 | 2015 FCA 241 | Procedural Motion | Appeal of earlier TCC case on whether privilege in GAAR case waived in respect of certain opinions. | Privilege | Dismissed | No | NOËL C.J. SCOTT J.A. DE MONTIGNY J.A. | Perry Derksen Raj Grewal | Joanne Vandale Me Al Meghji | http://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/126320/index.do?r=AAAAAQA5R0FBUiBvciAiMjQ1KDIpIiBvciBSR0FFIG9yICJHZW5lcmFsIGFudGktYXZvaWRhbmNlIHJ1bGUiAQ | Procedural Mottion so no score. | |||||||||||

| 1077 | 2015-10-01 00:00:00 | Birchcliff Energy Ltd. | TCC | 2012-1087(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=147165 | PWC Law LLP | General Anti Avoidance Rule - GAAR | Appealed to Higher Court | Birchcliff Energy Ltd. v. The Queen | November 18, 2013 | 2012-03-13 00:00:00 | 2019-08-21 00:00:00 | 2015 TCC 232 | Appealed to Higher Court | Seeding of predecessor to an amalgamation to avoid change of control restrictions and loss streaming rules, whether subject to GAAR. | 111(5) | GAAR | Allowed | Denied | Appealed | Appealed | Yes | Robert James Hogan | Robert Carvalho Neva Beckie Jonathan Wittig | Patrick Lindsay Jean-Philippe Couture | http://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/120135/index.do | ||||||||

| 1091 | 2015-06-11 00:00:00 | Deans Knight Income Corporation | TCC | 2014-4148(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=161482 | Burnet Duckworth & Palmer LLP | General Anti Avoidance Rule - GAAR, iNput Tax Credits | Appealed to Higher Court | Deans Knight Income Corporation v. The Queen | June 3, 2015 | October 24, 2014 | 2021-08-25 00:00:00 | 2015 TCC 143 | Case Management Conference Held | Motion to strike, Reply discloses no reasonable grounds for opposing the appeal or to strike portions of Reply that are irrelevant or prejudicial. Denied with costs, The object, spirit or purpose of the provisions in question is something that the trial judge has to determine. | Procedural Motion | Dismissed | No | David E. Graham | Robert Carvalho, Perry Derksen Sara Fairbridge | Michel H. Bourque Heather R. Diregorio | http://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/110128/index.do | ||||||||||||

| 1082 | 2015-05-22 00:00:00 | Superior Plus Corp. | TCC | 2013-2939(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=154806 | Osler, Hoskin & Harcourt LLP | Non Capital Losses | Closed | Superior Plus Corp. v. The Queen | February 19, 2015 | 2013-08-07 00:00:00 | 2018-04-26 00:00:00 | 2015 TCC 132 | Appealed to Higher Court | Procedural Motion 111(4), 111(5), 37(6.1) and 127(9.1) | GAAR | Allowed Mostly | Appealed | Appealed | NA | Robert James Hogan | Raj Grewal Perry Derksen Shankar Kamath | Al Meghji Edward Rowe Joanne Vandale | http://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/109841/index.do | ||||||||||

| 1078 | 2015-03-20 00:00:00 | Burlington Resources Finance Company (Conocco) | TCC | 2012-2683(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=148934 | Osler, Hoskin & Harcourt LLP | Penalties | Ready to be scheduled | Burlington Resources Finance Company v. The Queen | December 9, 2014 | 2012-06-26 00:00:00 | 2015-03-20 00:00:00 | 2015 TCC 71 | Adj. prior to hearing - Sine die | Procedural Motion | Allowed | NA | Diane Campbell | Jenny Mboutsiadis, Erin Strashin | Martha MacDonald, Brynne Harding | http://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/108765/index.do | 2002 | 12.22 | 2.73 | ||||||||||

| 1074 | 2015-01-21 00:00:00 | Solutions MindReady R&D inc. | TCC | 2011-4075(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=145956 | BCF s.e.r.c.r.l. | General Anti Avoidance Rule - GAAR | Closed | Solutions MindReady R&D inc. c. La Reine | May 6, 2014 | 2011-12-23 00:00:00 | 2017-02-02 00:00:00 | 2015 TCC 17 | Dismissed | Whether corporation a CCPC and entitled to Refundable ITC. | 89(1), 125(7) | GAAR | Dismissed | No finding | 1 | 0 | No | Réal Favreau | Julie Gaudreault-Martel | Anne Poirier Dany Leduc | http://decisions.fca-caf.gc.ca/tcc-cci/decisions/en/item/100619/index.do | 2005 | 11.1 | 5.12 | |||||

| 1072 | 2014-10-21 00:00:00 | J.K. Read Engineering Ltd. | TCC | 2011-3732(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=145518 | Felesky Flynn LLP | Capital Cost | Closed | J.K. Read Engineering Ltd. v. The Queen | April 30, 2014 | 2011-11-16 00:00:00 | 2016-12-01 00:00:00 | 2014 TCC 309 | Dismissed | Interest computation on a GAAR assessment. | Interest Computation on GAAR | Dismissed | No Finding | NA | Robert James Hogan | David Everett | James C. Yaskowich | http://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/98189/index.do | 2007 | 8.93 | 5.05 | Not a GAAR Case per se, just the interest. | |||||||

| 1068 | 2014-10-14 00:00:00 | Brent Kern Family Trust | FCA | A-375-13 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Thompson Dorfman Sweatman LLP | Income from Dividends | Closed | Brent Kern Family Trust v. Canada | 2014-10-14 00:00:00 | 2010-06-07 00:00:00 | 2014-10-14 00:00:00 | 2014 FCA 230 | Dismissed with Costs | 75(2) Attribution | GAAR | Dismissed | No Finding | 1 | 0 | No | DAWSON J.A. STRATAS J.A. NEAR J.A. | Deen Olsen Adam Gotfried | Jeff D. Pniowsky | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/98264/index.do?q=Brent+Kern+Family | 2005 | 8.79 | 4.36 | ||||||

| 1064 | 2014-05-30 00:00:00 | Spruce Credit Union | FCA | A-475-12 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Blake, Cassels & Graydon LLP | Dividend/GAAR | Closed | Canada v. Spruce Credit Union | December 11, 2013 | 2009-10-05 00:00:00 | 2014-05-30 00:00:00 | 2014 FCA 143 | Dismissed | 137.1 | GAAR | Dismissed | Dismissed | 0 | 1 | Yes | TRUDEL J.A. DAWSON J.A. NEAR J.A. | Robert Carvalho Bruce Senkpiel David Everett | Robert Kopstein Peter Rubin Edward Rowe | 0 | 1 | http://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/71730/index.do | 2005 | 8.42 | 4.65 | ||||

| 1069 | 2014-05-20 00:00:00 | Vincenzo Barrasso | TCC | 2010-2651(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=140112 | BCF s.e.r.c.r.l. | Capital Loss | Closed | Barrasso v. The Queen | February 12, 2014 | 2010-08-23 00:00:00 | 2018-03-27 00:00:00 | 2014 TCC 156 | Dismissed | Capital loss generated by a value shift. | GAAR | Dismissed | 1 | 0 | Yes | Brent Paris | Natalie Goulard | Serge Fournier | 1 | 0 | http://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/71768/index.do | 2003 | 14.25 | 7.6 | |||||

| 1046 | 2014-05-15 00:00:00 | Kossow | SCC | No. 35756 | https://www.scc-csc.ca/case-dossier/info/dock-regi-eng.aspx?cas=35756 | Richler and Tari | Charitable Donations | Closed | Kathryn Kossow v. Her Majesty the Queen | Written | 2005-06-14 00:00:00 | 1970-01-01 00:00:00 | No. 35756 | Dismissed with Costs | Leave to Appeal | Application for Leave | Dismissed | 0 | 0 | No | LeBel, Karakatsanis and Wagner JJ. | https://decisions.scc-csc.ca/scc-csc/scc-l-csc-a/en/item/13655/index.do?q=35756 | ||||||||||||

| 1066 | 2014-04-23 00:00:00 | Guy Gervais | TCC | 2010-71(IT)G | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=137421 | BCF s.e.r.c.r.l. | General Anti Avoidance Rule - GAAR | Closed | Gervais v. The Queen | August 21, 2012 | 2010-01-07 00:00:00 | 2018-08-09 00:00:00 | 2014 TCC 119 | Appealed to Higher Court | Small business capital gains duplication with spouse, directed by FCA to revisit GAAR. | 47(1) | GAAR | Dismissed | No Finding | Appealed | Appealed | No | Gaston Jorré | Josée Tremblay | Serge Fournier | https://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/71346/index.do | ||||||||

| 1060 | 2014-04-23 00:00:00 | Lehigh Cement Limited | FCA | A-327-13 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Thorsteinssons LLP | Tax Benefits | Closed | Lehigh Cement Limited v. Canada | 2014-04-08 00:00:00 | 2009-03-16 00:00:00 | 2014-04-23 00:00:00 | 2014 FCA 103 | Dismissed with Costs | In context of restructuring, two Canadian taxpayers acquired shares of a foreign corproation and deducted dividends on those shares. Disallowed under 95(6)(b). | 95(6)(b) | Dismissed | 0 | 1 | No | BLAIS C.J. SHARLOW J.A. STRATAS J.A. | Daniel Bourgeois | Warren Mitchell Matthew Williams | https://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/71098/index.do | 1996 | 17.32 | 5.11 | |||||||

| 1079 | 2014-03-07 00:00:00 | Descarries | TCC | 2013-12(IT)I | https://apps.tcc-cci.gc.ca/cf/docket/search_e.php?ap_id=151659 | KPMG Law LLP | Capital Dividend, General Anti Avoidance Rule - GAAR, Capital gain | Closed | Descarries v. The Queen | December 4, 2013 | 2012-12-21 00:00:00 | 2016-02-03 00:00:00 | 2014 TCC 75 | Dismissed | 84.1 | GAAR | Dismissed | Dismissed | 1 | 0 | Yes | Robert James Hogan | Natalie Goulard | Marie-Josée Michaud | 1 | 0 | http://decision.tcc-cci.gc.ca/tcc-cci/decisions/en/item/67218/index.do | 2005 | 10.1 | 3.12 | ||||

| 1053 | 2014-02-07 00:00:00 | Swirsky | FCA | A-117-13 Follow the link (right) to the FCA's Court File Database and search by party or number. | https://www.fca-caf.ca/en/pages/hearings/court-file-database | Miller Thomson LLP | Loan v Reimbursement of expenses, GAAR | Closed | Swirsky v. Canada | 2014-02-04 00:00:00 | 2007-09-25 00:00:00 | 2014-02-07 00:00:00 | 2014 FCA 36 | Dismissed | Spousal loans and whether interest deductible, or subject to GAAR. | 20(1)(c) | GAAR | Dismissed | NA | 1 | 0 | No | DAWSON J.A., STRATAS J.A., NEAR J.A. | Bobby J. Sood, Patricia Lee, Sandra K.S. Tsui | David W. Chodikoff, Patrick Déziel, Brahm Taveroff | http://decisions.fca-caf.gc.ca/fca-caf/decisions/en/item/66815/index.do | 1991 | 22.12 | 6.38 | |||||